Real-Time Payments (RTP) and Account-to-Account (A2A) Finance: A Cross-Country Analysis of Emerging and Developed Economies

A cross-country study on how emerging economies are redefining payment efficiency while advanced markets struggle with legacy systems.

Executive Summary

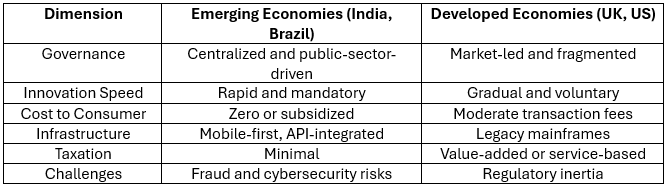

Real-time payments are redefining how nations connect people, money, and technology. They mark a shift from traditional financial systems to digital frameworks that promote access, transparency, and speed. Emerging economies like India and Brazil show that when payment systems are treated as public infrastructure, innovation and inclusion can grow together. Their success lies in clear regulation, strong central bank leadership, and open-access models that make digital finance simple and universal.

Developed markets, in contrast, face hurdles from legacy systems and fragmented policies. Despite strong private innovation, the absence of unified strategies has slowed progress. This reveals a key lesson—modernization in finance depends as much on coordination and governance as on technology itself.

Globally, the future of payments is moving toward one standard: open, interoperable, and inclusive networks that connect economies in real time. Nations that build systems around these principles will not only modernize payments but also drive broader financial empowerment and economic resilience.

Global Trends and Policy Insights

Real-Time Payments (RTP) as a Global Trend: RTP and account-to-account (A2A) systems are redefining financial infrastructure worldwide, enabling instant, secure, and transparent fund transfers.

Emerging Economies Lead Through Policy and Inclusion: India’s UPI and Brazil’s Pix exemplify how government-backed, zero-fee digital infrastructure can achieve mass adoption, financial inclusion, and socio-economic impact.

Developed Markets Face Structural Barriers: Despite advanced technology, countries like the U.S. and U.K. encounter slower RTP adoption due to legacy systems, fragmented governance, and market-driven incentives.

Centralized Governance Accelerates Adoption: Public-sector-led initiatives with mandatory participation, mobile-first infrastructure, and interoperable APIs facilitate rapid innovation and high user engagement in emerging markets.

Private-Sector Innovation Complements Public Infrastructure: Fintechs and technology providers such as Plaid, TrueLayer, and Stripe accelerate RTP adoption by integrating A2A capabilities, supporting both consumer and business ecosystems.

Population Dynamics and Network Effects Matter: Large populations in emerging economies create network effects, supporting billions of monthly transactions and enabling digital credit scoring, lending, and broader financial services.

Cost and Accessibility as Key Drivers: Low or zero transaction fees significantly boost adoption in emerging markets, while moderate fees in developed economies create adoption barriers despite higher income levels.

Future of RTP Includes Cross-Border Interoperability: Projects connecting UPI, Pix, and EU Instant Payments are setting the stage for regional and global RTP corridors, programmable payments, and automated settlement systems.

Policy Implications: Sustainable RTP systems rely on treating financial infrastructure as a public digital good rather than a purely commercial tool, balancing innovation, inclusion, and regulatory oversight.

Emerging Economies as a Model: Developed markets can learn from emerging economies by prioritizing centralized coordination, interoperable systems, and cost-efficient solutions to achieve both financial modernization and social inclusion.

1. Introduction

The transition from traditional financial networks to open, interoperable digital ecosystems is defining the new era of global finance. Real-time payment systems (RTP) are central to this evolution, enabling instant fund transfers, lower costs, and transparent settlements [1].

While developed markets pioneered open banking and fintech ecosystems, emerging economies have overtaken them in real-time transaction volume, user reach, and policy coordination. Systems like India’s UPI and Brazil’s Pix exemplify inclusive innovation, while the UK’s FPS and US FedNow illustrate how institutional fragmentation can slow digital progress [2].

2. Framework of Real-Time Payments and A2A Systems

Real-time payments allow direct, instant, and irrevocable fund transfers between bank accounts. These systems are supported by Application Programming Interfaces (APIs), ISO 20022 messaging standards, and strong data security protocols [3].

Key Features:

Speed: Settlement within seconds

Cost Efficiency: Minimal or no transaction fees

Transparency: Real-time visibility and traceability

Inclusion: Extends services to previously underserved populations

Mobile-First Infrastructure: Enables mass adoption and supports digital IDs

3. Comparative Country Analysis

4. Industry Players Driving RTP Innovation

Real-time payments are not only a result of regulatory initiatives but also of private-sector innovation. Across both emerging and developed economies, technology firms, payment networks, and financial institutions are accelerating RTP and A2A integration.

5. Emerging Economies: Innovation Through Inclusion

India – UPI

UPI records over 11 billion monthly transactions and continues to expand cross-border with Singapore’s PayNow [6]. Its zero-fee model, government backing, and open-access APIs have turned it into a public good.

Brazil – Pix

Pix cover 75% of Brazil’s adult population, supporting everything from welfare disbursements to tax payments [7]. With central bank enforcement and free transfers, Pix integrates seamlessly into daily commerce and government operations.

These cases show that innovation can emerge from necessity—public infrastructure and policy alignment can outperform private innovation in achieving inclusion and scale.

Using mobile technology infrastructure, open standards, and astute regulations, these case studies from the emerging economies show how they have leapfrogged ahead of the developed economies in the areas of RTP and A2A finance [10].

6. Developed Economies: Complexity & Fragmentation

United Kingdom – FPS

Despite its early start in 2008, the Faster Payments Service (FPS) faces challenges modernizing its infrastructure. The New Payments Architecture (NPA) aims to improve performance but remains delayed [3].

United States – FedNow

The FedNow system launched in 2023 and coexists with private networks like RTP and Zelle. By 2024, participation reached only 15% of U.S. financial institutions [4].

Unlike emerging economies that mandate adoption, developed economies rely on market incentives, creating inefficiencies, higher costs, and slower inclusion.

7. Comparative Policy and Implementation Challenges

8. Population and Adoption Dynamics

Emerging markets benefit from population-driven network effects and state-backed interoperability.

India (1.43 B) and Brazil (216 M) reach billions of transactions monthly under centralized frameworks.

Developed economies—despite higher incomes - struggling with adoption barriers tied to legacy costs and fragmented incentives [8].

Moreover, UPI and Pix provide behavioral data for credit scoring and digital lending—expanding access to finance beyond traditional banking. Developed economies remain limited to payment innovation without equivalent social or economic spillovers.

9. Future Outlook (2025–2027)

The global trend points to cross-border RTP interoperability, with projects like UPI–PayNow and Pix–LATAM corridors already in motion [1].

2025: EU completes Instant Payments integration.

2026: Regional corridors emerge across Asia and Latin America.

2027+: Programmable payments integrate with blockchain and smart contracts for automated settlement.

10. Conclusion

Real-time payments are the new foundation of digital financial infrastructure, bridging the gap between economic growth and social inclusion. Emerging economies have proven that public-led systems can drive private innovation, not stifle it.

India’s UPI and Brazil’s Pix demonstrate that transparent governance, zero-cost design, and interoperable APIs can deliver massive adoption—even among low-income and unbanked populations [6],[7].

In contrast, developed markets face systemic inefficiencies due to fragmented governance, reliance on private networks, and profit-oriented cost structures. Their slower adoption reflects not a lack of technology, but a lack of unified policy and shared vision.

For policymakers, the key lesson is that infrastructure-led inclusion—supported by central banks, digital ID systems, and open access APIs—can generate greater long-term economic value than fragmented market competition.

Looking ahead, the integration of real-time payments, open finance, and programmable money could enable full cross-border interoperability. As regions connect UPI, Pix, and EU Instant Payments into unified corridors, the financial system will move closer to global real-time liquidity, reshaping trade, remittances, and consumer finance at scale.

In short, emerging markets have set the pace, and developed markets must now learn from them—by treating real-time finance not as a profit tool but as a public digital asset essential to the next decade of economic resilience.

References

[1] Bank for International Settlements (BIS). (2024). Interlinking Fast Payment Systems: Building Blocks for Cross-Border Connectivity. https://www.bis.org/cpmi/publ/brief7.pdf

[2] International Monetary Fund (IMF). (2023). Fintech and Cross-Border Payments: Towards Global Interoperability. https://www.imf.org/en/Publications/fintech-note/Issues/2023/01/Fintech-and-Cross-Border-Payments-Towards-Global-Interoperability

[3] European Central Bank (ECB). (2023). Instant Payments in Europe: A Blueprint for Pan-European Reach. https://www.ecb.europa.eu/pub/pdf/other/ecbinstantpaymentsblueprint2023.en.pdf

[4] McKinsey & Company. (2024). Global Payments Report 2024: Real-Time Growth and the Next Wave of A2A Innovation. https://www.mckinsey.com/industries/financial-services/our-insights/global-payments-report-2024

[5] World Bank. (2022). Real-Time Retail Payments Systems: Enabling Financial Inclusion Through Instant Transfers. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/090224b08408f9ad/real-time-retail-payments-systems-enabling-financial-inclusion-through-instant-transfers

[6] EY & Confederation of Indian Industry (CII). (2024). India’s UPI: Behavioral Shift in Rural Finance. https://www.ey.com/en_in/newsroom/2024/12/upi-most-preferred-payment-mode-for-38-percent-indians-in-rural-and-semi-urban-areas

[7] European Payments Council (EPC). (2024). Pix: Brazil’s Leading Instant Payment Scheme. https://www.europeanpaymentscouncil.eu/news-insights/insight/pix-latest-updates-brazils-leading-instant-payment-scheme

[8] Atlantic Council. (2024). Fast Payments in Action: Lessons from Brazil and India. https://www.atlanticcouncil.org/blogs/econographics/fast-payments-in-action-emerging-lessons-from-brazil-and-india

[9] Harvard Business School. (2024). FinTech Lending and Cashless Payments. https://www.hbs.edu/faculty/Pages/item.aspx?num=65409

[10] Keun Lee, Economics of Technological Leapfrogging In: The Challenges of Technology and Economic Catch-up in Emerging Economies. Edited by: Jeong-Dong Lee, Keun Lee, Dirk Meissner, Slavo Radosevic, and Nicholas S. Vonortas, Oxford University Press (2021). https://doi.org/10.1093/oso/9780192896049.003.0005

Valuable cross-country perspective, the contrast between centralized governance in emerging markets and fragmented systems in developed ones resonates with the liquidity and operational efficiency themes TCLM covers. If you're tracking how payment infrastructure shapes B2B finance, it’s worth a look.

(It’s free)- https://tradecredit.substack.com/