In A World Awash with Digital Wallets, What Should We Do To Help Users?

Open wallets are the answer for a better user experience that is more secure.

Executive Summary

This article introduces digital wallets and describes the three main use cases for digital wallet today, which are around payments, identity, and access. Specific examples around each of these uses cases are outlined. Digital wallets are closely linked to mobile phones and as such these wallets continue to gain popularity across the world as a means of payment. The article briefly describes how digital wallets work. Next, the challenges of the current digital wallet ecosystem are discussed, in particular it is shown how the current litany of isolated digital wallets that are not standards-based leads to data silos which impact the users’ experience and also presents them with security vulnerabilities. The article discusses why open wallets are the way to address the challenges facing the digital wallets ecosystem today. Finally, the Open Wallets Foundation is introduced as an organization seeking to build a digital wallets ecosystem that is based on open standards and open-source.

Introduction

The use of digital wallets continues to grow globally in conjunction with the increased use of mobile phones and other smart devices. Besides their use as a tool for payments, digital wallets have the potential to lead to the building of a financial environment that is decentralized, disintermediated, democratized, disaggregated, debiased and where individuals have more financial autonomy. This is the case especially when the concept of open digital wallets is combined with others such as the blockchain and open banking which are the focus of this newsletter.

In this article we introduce digital wallets and describe the three main use cases for digital wallet today, which are around payments, identity, and access. We outline specific examples around each of these uses cases. Digital wallets are closely linked to mobile phones and as such these wallets continue to gain popularity across the world as a means of payment. We also briefly describe how digital wallets work. The challenges of the current digital wallet ecosystem are discussed, in particular we show how the current litany of isolated digital wallets that are not standards-based leads to data silos that impact the users’ experience and also presents them with security vulnerabilities. We discuss why open wallets are the way to addressing the challenges facing the digital wallets ecosystem today. Finally, we introduce the Open Wallets Foundation, an organization seeking to build a digital wallets ecosystem based on open standards and open-source.

What is a Digital Wallet?

Much like its physical counterpart, a digital wallet is a secure place on a smartphone or a smart device where important digital items (assets) such as financial account information or digital identity information are encrypted and stored. Today digital wallets are mainly used for three functions: payments, digital identity, and digital access. Digital wallets can be used to facilitate payment for products online or in physical stores at a point-of-sales (POS) terminal. Digital wallets can also be used to prove one’s identity, for example when used in an e-passport, and to enable access to services when for example they store things like train or concert tickets.

Google Pay, Apple Pay and Samsung Pay are some of the more well-known digital wallets that can be used both online and offline. While PayPal, Venmo, CashApp, and Zelle are other well-known digital wallets in the U.S. with more usage in online or mobile transactions. Around the world there are several digital wallets, such as M-Pesa, AliPay, WeChat, Tingo Money, GCash, and Orange Money which are used primarily for mobile payments1.

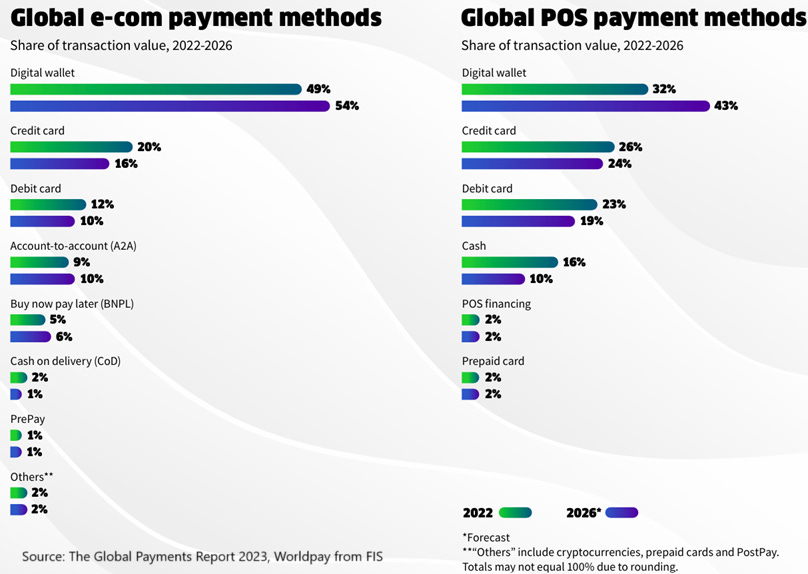

One area where digital wallets dominate is in payments. According to 2023 global payments report by Worldpay from FIS2, digital wallets will continue to be the leading payment method for both e-commerce and POS retail, as can be seen from Figure 1.

How Digital Wallets Work

Next, we present a brief overview of how digital wallets work. We will use payments as a use case for this overview.

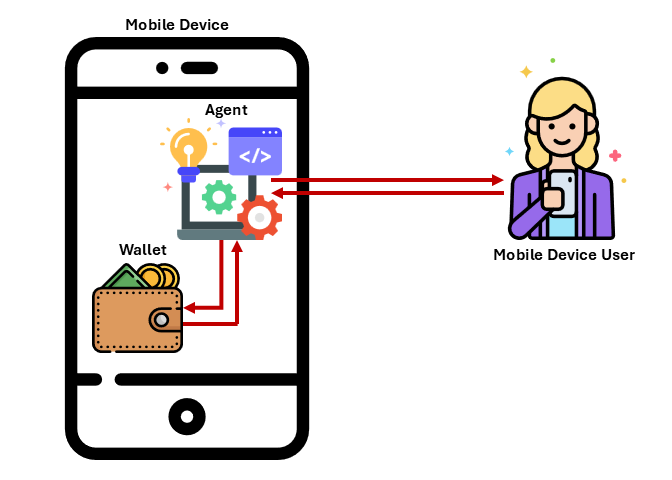

The digital wallet is a secure container in the mobile device where the digital assets are stored and can be accessed from. An agent is a software module that can put digital assets into the container or access the digital assets in the container. The mobile user accesses their digital wallet through the agent as shown in Figure 2.

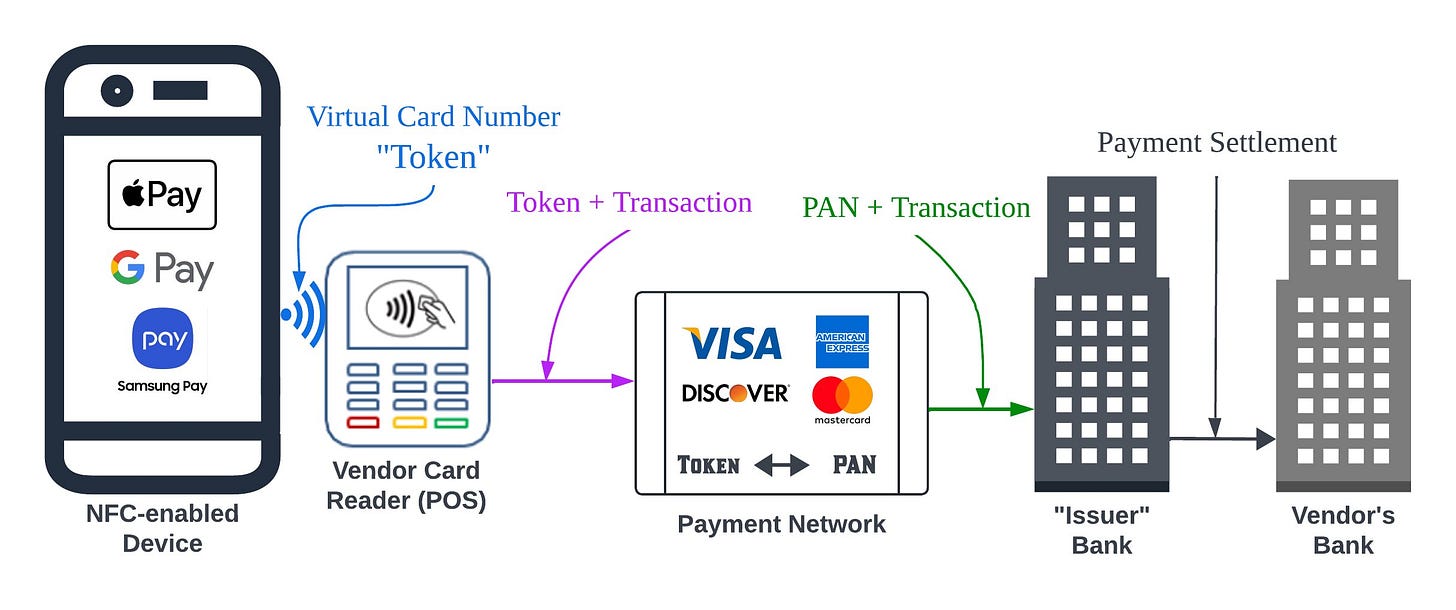

Figure 3 from Anwar et al.3 shows a mobile device with a digital wallet using Near-Field Communication-enabled POS to facilitate a purchase via a credit card payment network.

A more detailed presentation of how digital wallets work will be provided in a future article.

Uses of Digital Wallets

Besides payments, digital wallets may be used to store4:

Credit or debit cards

Passwords or keys

Cryptocurrencies

Boarding passes

Hotel reservations

Concert tickets

Gift cards

Coupons

Loyalty-rewards cards

Challenges with Today’s Digital Wallet Ecosystem

Many of today’s digital wallets are designed, developed, and supported using a black box model that is controlled by a single organization. In many cases it is not known how the user data is stored and secured in the wallet, that is these organizations have adopted the security through obscurity paradigm5. In the black box model, once the user’s data enters the digital wallet often it cannot be shared with other wallets as there are at present no standards for wallet interoperability. Users cannot easily transfer their data to a competing digital wallet or have one wallet work with another in a federated fashion. The user wanting to use another competing digital wallet has to sign-up for that wallet and potentially recreate the stored data that is the present situation creates vendor lock-in with the data silos as a by-product. These data silos increase data redundancy and potentially increase the security risks for users as they may have their data in multiple locations (wallets).

Graham6 lists the following as additional limitations of the current digital wallet ecosystem:

Questionable security

Intrusive business models

Limited capabilities

Open Wallets As the Way Forward

Digital wallets based on open standards and open-source promise to address the challenges mentioned above. Leading the charge in this effort is the Open Wallet Foundation (OWF) which is one of the Linux Foundation projects. OWF “brings developers, standard development organizations and academia together to facilitate global interoperability of verifiable credentials, by establishing best practices and through collaborative development of digital wallet technology to enable standards-based OSS (open source software) components that issuers, and wallet providers can rely on.”7

We will discuss more about the OWF projects in future are articles, but in the meantime we want to bring to the attention of our readers the Open Digital Wallet – Infographic from the OWF.

Conclusion

In this article we introduced digital wallets and described the three main use cases for digital wallet today, which are around payments, identity, and access. We outlined specific examples around each of these uses cases. Digital wallets are closely linked to mobile phones and as such these wallets continue to gain popularity across the world as a means of payment. We provided a brief description of how digital wallets work. The challenges of the current digital wallet ecosystem were discussed, in particular we showed how the current litany of isolated digital wallets that are not standards-based leads to data silos that impact the users’ experience and also presents them with security vulnerabilities. We discussed why open wallets are the way to address the challenges facing the digital wallets ecosystem today. We concluded by introducing the Open Wallets Foundation, an organization that is seeking to build a digital wallets ecosystem based on open standards and open-source.

Remitly, “11 Popular Mobile Wallets from Around the World,” December 30, 2024 https://blog.remitly.com/finance/popular-mobile-wallets-around-world/

The Global Payments Report 2023, FIS, https://www.fisglobal.com/-/media/fisglobal/files/campaigns/global-payments%20report/FIS_TheGlobalPaymentsReport_2023.pdf

New study reveals loophole in digital wallet security—even if rightful cardholder doesn't use a digital wallet,” TechXplore, August 14, 2024. https://techxplore.com/news/2024-08-reveals-loophole-digital-wallet-rightful.html

L. Hund and R. Bennett, "A Beginner’s Guide to Digital Wallets," Bankrate, September 30, 2024. https://www.bankrate.com/banking/what-is-a-digital-wallet/

Common Weakness Enumeration, CWE-656: Reliance on Security Through Obscurity, https://cwe.mitre.org/data/definitions/656.html

G. Graham, "Why the World Needs an Open Source Digital Wallet Right Now," The Linux Foundation, February 2023. DOI: 10.70828/ZEHC9956

The OpenWallet Foundation, https://openwallet.foundation/