How Digital Wallets are Reshaping the Payments

We look at how the use of digital wallets in the US has changed over the last 5 years, with increased adoption across all age groups. We also highlight how open standards may help address challenges.

Introduction

Digital wallets, also known as e-wallets, have become integral to daily life in the United States, offering convenience and efficiency in financial transactions. These digital tools allow users to store payment information securely on their devices, facilitating swift payments both online and in-store. Services like PayPal, Apple Pay, and Google Pay have gained widespread adoption, simplifying the purchasing process for many users and clients.

Despite their growing popularity, many billers don’t offer digital wallet payments. This has created a gap between consumer preferences and the payment experience their billers offer.

PayNearMe recently conducted a survey to determine how important convenience and hyper-personalization are to consumers during the loan payment process. Research revealed that borrowers are increasingly gravitating toward digital wallets as a loan payment option, while their tolerance for friction is decreasing. 12

Consumer trends: alternative payments methods

An important part of making payment easier for consumers, ultimately driving on-time payments—is offering the payment types they use in other areas of their lives. Today, that includes digital wallets. In the consumer survey, when asked which alternative payment methods are important to them when paying loans online 44% of respondents said Venmo, 55% said PayPal and 43% said Cash App Pay.

These digital wallets have seen remarkable growth in preference since a previous report published by PayNearMe in 2021. Since then, survey respondents noted significant increases in preference for “the big three” as a loan payment option:

Venmo (27% in 2021 - a 63% increase)

PayPal (43% in 2021 – a 26% increase)

Cash App (22% in 2021 – a 95% increase)

Apple pay (15% in 2021)

This increase highlights a strong shift toward these platforms, indicating a competitive landscape where digital wallets are becoming integral to how people manage payments.

What we learned confirms a clear preference: consumers want to pay bills with wallets, and billers are missing an opportunity to attract and retain customers (PayNearMe, 2024).3

Impact of Digital Wallets on the Daily Life of Consumers

The adoption of digital wallets has significantly altered consumer behavior. A 2024 survey revealed that 53% of consumers now use digital wallets more frequently than traditional payment methods, highlighting a shift towards more convenient payment solutions (Cardaq, 2024),(Russ, 2022).

Payments Dive

This trend is particularly evident among younger demographics, with millennials and Gen Z users leading the charge in adopting digital payment methods.

Benefits

Convenience: Digital wallets streamline transactions, reducing the need to carry physical cards or cash.

Security: Advanced encryption and authentication methods protect user data, making digital wallets a secure alternative to traditional payment methods.

Financial Inclusion: E-wallets provide accessible financial services to unbanked populations, offering a gateway to digital payments and financial management.

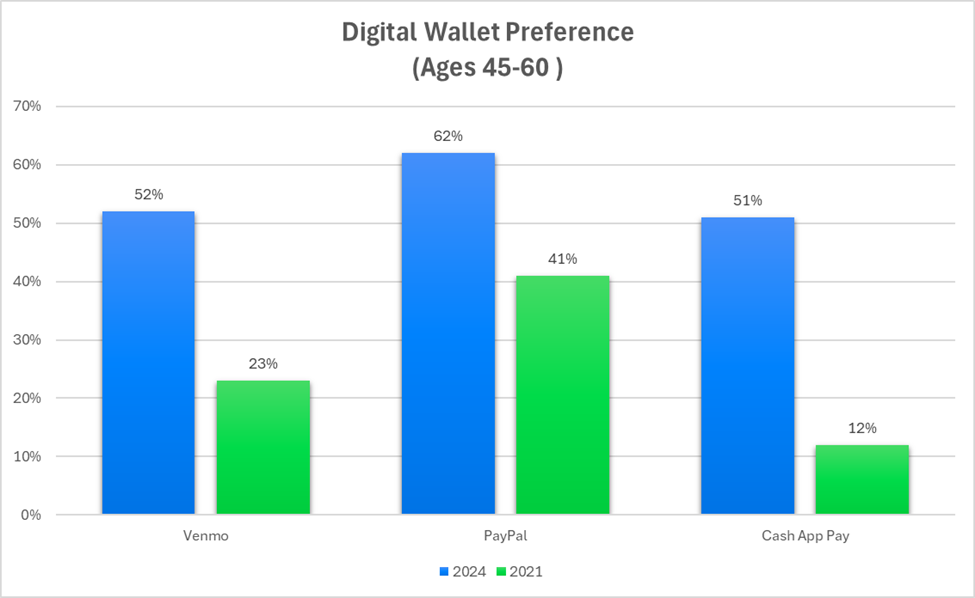

The PayNearMe (2024) survey shows the generational adoption pattern of digital wallets. It revealed a clear trend of increasing desire for alternative payments across all age groups. Most notably was an increased preference for digital wallets as a payment option for the 45–60-year-old age range from the 2021 report.

The data clearly defies the stereotype that digital wallets are predominantly used by younger consumers. This should serve as an incentive for billers to appeal to all their customers by offering the types they desire.

Survey says that with an income between $150,000 and $174,999 prefer Venmo (71%), PayPal (77%) and Cash App (66%). This diversification suggests that comfort with digital payments transcends economic status, making it a universal trend. Overall, what we’re seeing is that digital wallets have become pervasive across age and income ranges and are an important way to empower customers to self-serve and make on-time payments.

People use digital wallets in a variety of ways in their daily lives, making transactions more convenient, secure, and efficient.

Some Existing Use Cases for Digital Wallets

According to PayNearMe (2024) and Cardaq (2024), here are some of the common ways that digital wallets are being used today.

1. In-Store Purchases

Contactless Payments: One of the most common uses of digital wallets like Apple Pay, Google Pay, or Samsung Pay is making contactless payments in stores. Instead of swiping a physical credit card, users can simply tap their smartphone or smartwatch on a payment terminal to complete the transaction.

Speed and Convenience: This eliminates the need to carry multiple cards or cash, speeding up the checkout process and providing a hassle-free shopping experience.

2. Online Shopping

E-commerce Payments: Digital wallets are widely used for online purchases on websites like Amazon, eBay, or smaller e-commerce sites. By linking a credit or debit card to their wallet, users can easily make payments without re-entering card details every time.

Secure Checkout: Digital wallets provide an extra layer of security through encryption and tokenization, making online transactions safer.

3. Peer-to-Peer Payments (P2P)

Sending Money to Friends and Family: People use apps like Venmo, PayPal, or Cash App to quickly transfer money to others. Whether it’s for splitting bills, paying rent, or sending birthday gifts, digital wallets make sending money fast and simple.

Instant Transfers: These apps often allow users to send money instantly without waiting for business hours or bank processing times.

4. Subscription Payments

Automated Bill Payments: Many people link their digital wallets to subscription services like Netflix, Spotify, or cloud storage services to make automatic payments each month. This ensures uninterrupted access to services without having to manually pay every month.

5. Transit and Public Transportation

Commuting with Digital Wallets: In many cities, digital wallets are integrated into transit systems, allowing users to pay for bus or subway rides with their smartphone. For example, users can tap their phones on metro card readers or bus fare machines for seamless travel.

6. Loyalty Programs and Rewards

Storing Loyalty Cards: Many people store their loyalty or rewards cards digitally in their wallet. This includes cards for grocery stores, coffee shops, and airlines. This makes it easier to track and redeem rewards without carrying physical cards.

Discounts and Coupons: Digital wallets can also store discount codes and coupons, allowing users to automatically apply them during purchases.

Some Challenges Associated with Today’s Digital Wallets

According to Russ (2022), despite their advantages, digital wallets face several challenges:

1. Security Concerns

While digital wallets offer enhanced security features, they are not immune to threats. Issues such as device theft, phishing attacks, and data breaches pose significant risks. Ensuring robust security measures is crucial to protect user information.

2. Technological Dependence

Reliance on mobile devices for digital payments means that technical issues like software glitches, poor connectivity, or battery depletion can hinder transaction processes.

3. Market Fragmentation

The digital wallet market is fragmented, with various platforms offering different features and levels of acceptance. This fragmentation can lead to compatibility issues and limit the universality of digital wallet usage.

Interoperability based on open standards should help mitigate against items 2 and 3 above. We refer the reader to our The Case for Open Finance - Part 1 article for a discussion on the benefits of open standards and open source.

Conclusion

Digital wallets have transformed the financial landscape in the U.S., offering unparalleled convenience and security in daily transactions. However, addressing security vulnerabilities, technological dependencies, and market fragmentation is essential to fully harness their potential. As technology evolves, digital wallets are likely to become even more embedded in daily life, shaping the future of consumer payments.

PayNearMe, "How digital wallets are reshaping the payments landscape," May 13, 2024. https://www.paymentsdive.com/spons/how-digital-wallets-are-reshaping-the-payments-landscape/715213/

Cardaq, "The rise of digital wallets: Benefits and challenges," August 15, 2024. https://thepaymentsassociation.org/article/the-rise-of-digital-wallets-benefits-and-challenges/

Bree Ann Russ, "The Benefits and Risks of a Digital Wallet," March 22, 2022. https://www.idstrong.com/sentinel/the-benefits-and-risks-of-a-digital-wallet/